Dream11 Tax Calculator

Estimate tax deductions on your Dream11 winnings effortlessly.

Note: A 30% tax applies to winnings over ₹10,000.

Dream11 Tax Calculator

Dream11 has become one of India’s most popular fantasy sports platforms, attracting millions of fans eager to put their sports knowledge to the test. But as with any winnings, tax implications come along with it. This guide provides a detailed look at the Dream11 tax calculator, explaining the tax deductions, legal requirements, and other essential details that every Dream11 enthusiast should know.

1. Understanding Dream11 and Its Growing Popularity

Dream11 has revolutionized how fans interact with sports, enabling them to create teams and compete based on real-life match performances. Its appeal lies in the blend of skill and luck, making it possible to win real cash prizes. However, as earnings increase, tax obligations also come into play.

2. Why Dream11 Taxation is Important

If you’ve ever won a significant prize on Dream11, you might be aware of the taxes deducted at source (TDS). Any earnings above a certain threshold are subject to this deduction, ensuring compliance with Indian tax laws. This taxation applies to all games of skill that involve monetary rewards, so it’s crucial to understand how much you’re liable to pay.

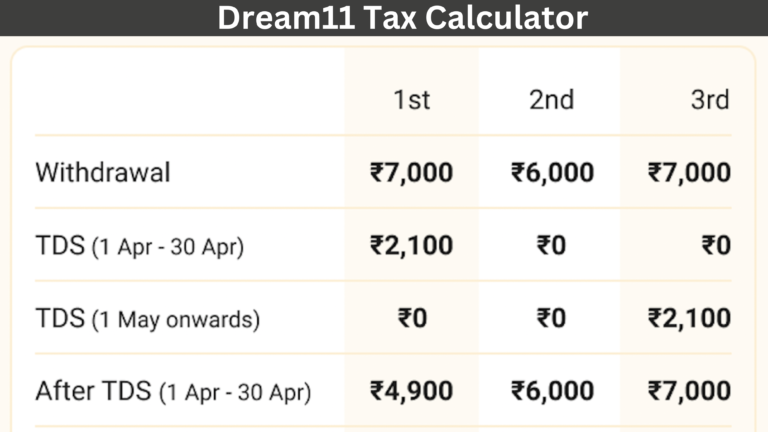

3. How the Dream11 Tax Calculator Works

The Dream11 Tax Calculator is an online tool that simplifies the tax calculation process. Enter your winning amount into the calculator, and it instantly displays the tax deducted at source (TDS) and the net amount you’ll receive. This is especially helpful if you want to estimate your earnings post-tax.

4. Thresholds and Tax Rates on Dream11 Winnings

In India, any winnings over INR 10,000 are subject to a 30% TDS. This tax is non-refundable, meaning you cannot claim it back even if your annual income falls below the taxable limit. For example, if you win INR 20,000 on Dream11, the platform will deduct 30% of it as TDS before crediting the remaining amount to your account.

5. Steps to Use a Dream11 Tax Calculator

Using the Dream11 tax calculator is straightforward:

- Enter your total winning amount: Input the amount you have won or expect to win.

- Press calculate: The tool will then calculate the tax and net earnings.

- Review the results: You’ll see the tax deducted and the final amount that will be credited to your account.

This feature allows players to plan their finances effectively, especially if they rely on these winnings as an income source.

6. Breakdown of Tax Deductions on Dream11

For winnings above INR 10,000, the tax calculation goes as follows:

- Amount Won: Total winnings on Dream11.

- Tax Deducted at Source (TDS): 30% of the winning amount, applicable only if winnings exceed INR 10,000.

- Net Payout: Total winnings minus TDS.

For example, if you won INR 15,000, TDS of 30% (INR 4,500) would be deducted, resulting in a net payout of INR 10,500.

7. Legal Implications of Non-Compliance with Tax Regulations

While Dream11 deducts TDS for winnings above the specified threshold, it’s also essential for players to declare these earnings in their income tax returns (ITR). Failing to report such income can lead to legal complications, including fines and interest on unpaid taxes. Proper tax filing ensures compliance and avoids any future disputes with tax authorities.

8. Differences Between TDS and Income Tax on Dream11 Earnings

While TDS is deducted at a flat rate of 30%, it’s essential to consider that your total income for the year might impact your tax liability. Here’s a quick rundown:

- TDS: Directly deducted by Dream11 for winnings over INR 10,000.

- Income Tax: Based on your overall income bracket, additional tax may or may not be payable after considering the TDS deducted.

9. Using Dream11 Winnings for Investments and Savings

After tax deductions, Dream11 winnings can still be substantial, and wise players often consider investing these funds. Options like mutual funds, fixed deposits, or other investment avenues are popular choices, allowing players to make the most of their winnings. When investing, remember to consider the post-tax amount to calculate potential returns.

10. Additional Tax Considerations for High Earners

For those who consistently win large sums, it’s essential to understand other tax implications. Individuals whose income places them in a higher tax bracket should consult a tax advisor to determine if additional Advanced Tax payments or any other tax-related obligations apply.

Conclusion

Understanding and managing the taxes on Dream11 winnings is crucial for any serious player. With the Dream11 Tax Calculator, you can easily calculate your tax liabilities, ensuring you’re always informed and prepared. While the 30% TDS can seem steep, planning ahead and accurately reporting earnings will keep you in good standing with tax authorities. So next time you win big, celebrate responsibly, knowing that your tax obligations are sorted!